FTX has been in the news for the past 2 days. All of it negative press, as they deserve. The company has officially applied for Chapter 11 bankruptcy. How could this happen? They had celebrity endorsements such as Steph Curry and Tom Brady. They had several commercials about their platform and trading crypto. So why the crash and what caused it? Let’s break it down.

What We Know

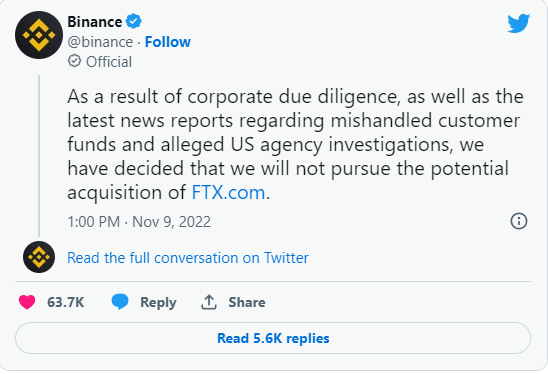

What happened first is on 11/10/2022, FTX announced that it was drastically underwater and that Binance was going to save the day. Binance originally thought about purchasing the platform and making it their own. However, after further investigation by Binance, they found a hole in FTX’s balance sheet of over $6 Billion, with a B. That scared Binance off immediately from purchasing them and they announced 4hrs later via Twitter they were bailing out of the acquisition. See the tweet below:

The following day it was announced that it was now only $5 Billion, with a B. That was still quite a hole they had to come up out of. FTX was known as the 2nd or 3rd, depending on who you ask, trading platform for Crypto. So how could this happen to such a “reputable” source?

The UGLY FTX

Upon digging into FTX and their holdings, it was discovered that they were lending loads more than they were making to startup companies. Most of these companies turned out to be shells. Shell companies refer to fake businesses to move money around or hide it. In short, they invested over $8 Billion into 448 venture-stage businesses that had 10 employees or less with no real documentation about the business. The kicker here is that they USED THEIR CLIENTS’ MONEY to leverage these “ventures”. When their clients and investors found out, they wanted their money back. FTX simply did not have it as they lost all of it. You heard that right. They LOST all $8 Billion dollars plus another $2 Billion. So, in total, they lost over $10 Billion dollars of investor and client money through Alameda, their trading arm. (Insert link to data crunch for Alameda trading ventures). The icing on the cake is their new CEO of FTX is the lawyer that tried to clean up Enron. You can read about the Enron scandal here (insert link to Enron scandal). It is also strangely unfortunate that the CEO and founder of FTX is a huge proponent of the SBF Bill.

FTX and Its Shady Connections

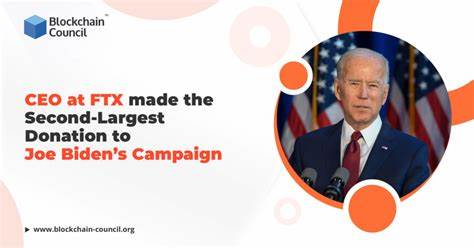

So, the SBF bill is essentially a way to increase government oversight to crypto firms, trading platforms and amp up regulations on the crypto market. Crypto.com and Coinbase have said this would ruin the DeFi mindset and blockchain environments built. Why would the founder of a crypto company or firm want this? Perhaps they were bought out to do this? It is definitely a bad look as stated by www.coinmarketcal.com. Another strange connection is that FTX and its founder were the second largest donors to Joe Biden’s Presidential Campaign. Sam Bankman-Fried donated $39.8 Million which is only behind George Soros ($128 million). Mr. Bankman-Fried out donated big names like Michael Bloomberg ($38 Million). He also stated that “promised to spend far more on Democrats moving forward, predicting in May that he’d fund “north of $100 million” and had a “soft ceiling” of $1 billion for the 2024 elections”. He has backed off the previous claim stating it was “dumb”. You can read the whole story here. It all seems too coincidental that they are all linked together. What will his clients think of this? Where does the crypto market go from here?

Going Forward

For now, it seems like the Crypto World is all topsy-turvy. Many “Influencers” have vanished over their support for FTX and others believe that FTX was a nail in the impending coffin for crypto. But is it truly over? The answer is no. Not at all. Setbacks? Yes, absolutely. Companies like Crypto.com and Binance are offering full transparency and trying to help calm this storm. It will take only the good guys to fix this. It is also important to understand all markets go through this. Remember several companies on the stock market helped fuel the collapse in 2008. Whether you stay in Crypto or not, the blockchain and Cryptocurrencies are here to stay for the foreseeable future, provided there are good guys staying in the market.