VeChain was founded to track products to eliminate fraud, but is itsReal-World Application Killing VET’s Value

Authenticating Luxury Goods

When Sunny Lu founded Vechain in 2015, he sought to prevent handbag knockoffs and eliminate industry fraud. His platform offers blockchain-based security to track products from start to delivery using old-school NFC (near-field communication), sensors, and RFID tech (Radio Frequency ID) in combination with smart contracts and IoT (Internet of Things) to track products in real time and ensure authenticity. But after switching VEN to VET, not much thought was given to its real-world application killing VET’s value

From BMW to Walmart, over 40 plus companies use VeChain to manage their products throughout the shipping process. Tracking starts as the product’s one-of-a-kind identity is added to the blockchain, creating authenticity. Sensors, NFC, and RFID ensure the product is the same throughout its production until delivery. The purchase is thus verifiable to the customer, who knows they are receiving the genuine article, not a knockoff.

VeChain is currently being used in the food production industry to verify the origin of the food’s source and ensure the food gets to its destination. The medical industry is using VeChain smart contracts for security and verification purposes.

How VET and VeTHOR Come Into Play

In 2018, VeChain switched from Ethereum to the VeChain blockchain. VeChain replaced the original VEN with VET to conduct business on the VeChain to increase its capabilities. Unlike other cryptocurrencies, VeChain has two tokens, the other being VTHO. While this sounds complicated, if you think of VET as a train and VTHO as the coal, you will better understand that VET is how you transfer and store (train) value from one person to another. VTHO is the energy behind the transfer (coal.) The use of both allows a smooth authentication process and keeps volatility low. VHTO and VET are accessible to the public for investment, selling, holding, and purchase.

While many use their crypto to create a passive income, VeChain’s less-than-stunning rewards and the need to crypto stake make it a poor passive income choice. Some investors wonder if the real-world application is killing VET’s value.

If you choose to stake VET, you can use the VeChain mobile wallet or another blockchain wallet. Rewards on VeChain are tiered, but if you hold enough VET to make your Vechain wallet an economic node, you receive extra rewards. VET tokens in a VeChainTHOR mobile or SYNC wallet automatically earn VTHO. You can also stake VeChain through a crypto exchange wallet, with the payment being VET.

VET coin

Proof of Authority

While most cryptocurrencies use proof of stake (PoS) and proof of work (PoW) for transaction validation, Vechain uses proof of authority. This process requires anyone wanting to be an Authority Masternode (the nodes that confirm transactions) to reveal their identity. The VeChain Foundation then puts them through a KYC (know-your-customer) procedure. There are also some minimum requirements to complete.

Proof of authority creates better centralization of VET. The nods must stake a minimum of 25 million VET to maintain optimum authority. Despite the extreme usefulness of VeChain’s blockchain, the token’s value may never surge. Of the 86 billion VET tokens, 72.51 billion-plus are currently in circulation. If VET could reach $1 in value, its market cap would be $86 billion, putting it 3rd for most valuable crypto.

April 17, 2021, saw VET’s all-time high reach $02782. October this year saw a drop of 90% if to $0.0230.

The VeUSD launch

VeChain launched its first stablecoin- VeUSD, in May. The stablecoin has USD backing for lower volatility and offers 1:1 redeemability in USD. It is a VIP-180 token (an ERC-20 standard sub-set) and provides an application programming interface or API list usable on the VeChainTHOR network. VeUSD offers users lower transaction fees and is used for cross-border payments, a boost for businesses on the VeChain that do business or ship globally.

VeUSD is the creation of VeChain Foundation and Stably, whose strict compliance with global and U.S. regulatory authorities allows the stablecoin to be regulated.

The VeChainTHOR blockchain’s liquidity pool (Vexchange) is automated. Its main uses are trading VeUSD and withdrawing Stably Prime for cash.

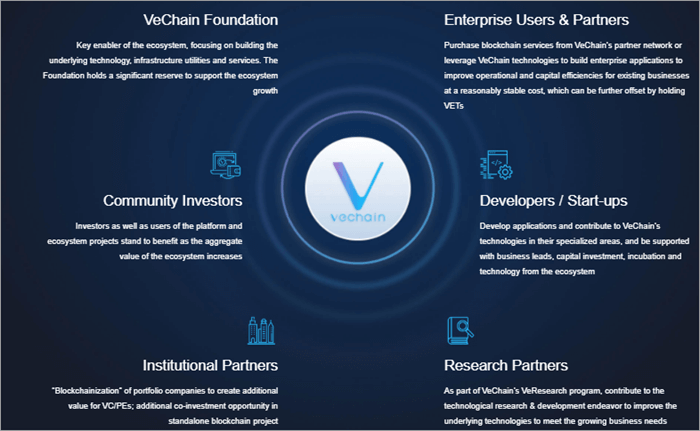

VeChain ecosystem

The VeChain Future

Because the USD backs the VeUSD, its future remains as stable as the U.S. dollar. Its role in the VeChain ecosystem is integral to its economic circle. It also has various uses in supply-chain management, settlement, and DeFi applications.

Unfortunately, real-world applications are killing VET’s value, which is what the foundation needs to create in the future. VeChain needs to generate hype around its cryptocurrency to compensate for the lack of value.

As more businesses use VeChain, the increase in users and developers will help to boost the value of VET and VeTHOR. Perhaps somewhere in the future, VeChain will create a VeNFT!